Crediting unposted Invoices

Supplier invoices that haven been posted, can be credited'by opening the Spill menu at the end of the row.

Choose Credit to create a credit of the unposted supplier invoice.

Crediting posted Invoices

To credit a posted Supplier Invoice, create a negative invoice in the same manner as a sales invoice.

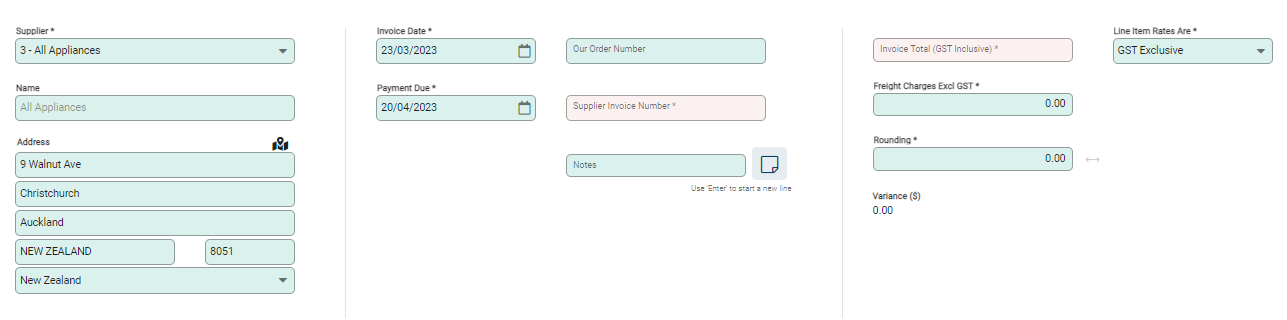

Go to the Suppliers module and to the Invoices menu, select +Add from the toolbar. Enter the same supplier information as the original invoice.

Include the following information:

- Supplier Invoice Number: The original invoice that the credit relates to.

- Invoice Total: The GST Inclusive amount of the refund.

- Line Item Rates Are: Set the invoice lines to GST Inclusive or Exclusive. All lines will apply at the rate identified in this field.

It is recommended to include the Infusion reference number applied when the invoice was created in Infusion to provide a clear reference path. Use Our Order Number, or if this is already allocated, update the Notes field.

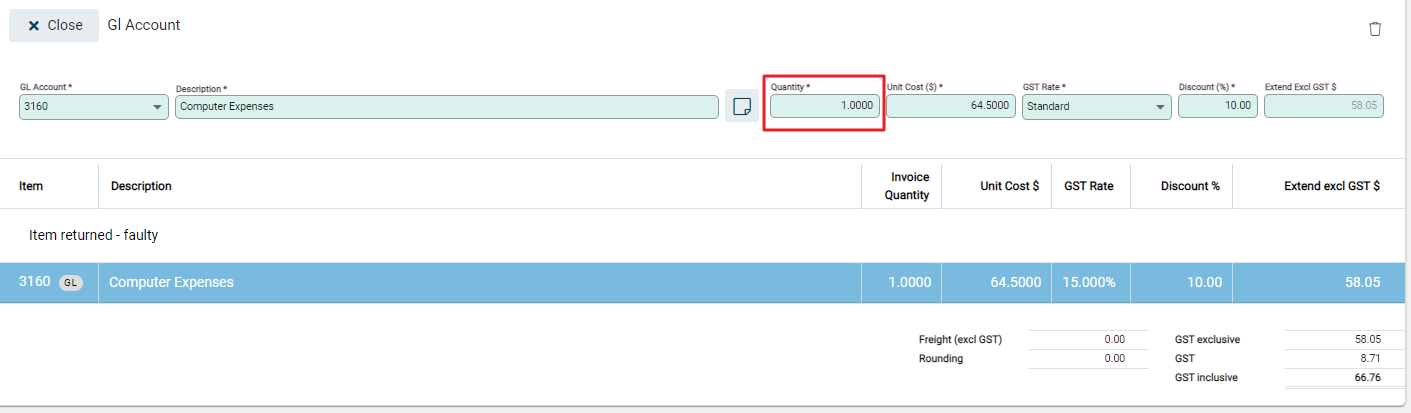

Enter GL accounts to be credited, using a negative quantity to reverse the lines from the original invoice. The Rate remains a positive value and the Extend GST calculates as a negative value.

Discounts are applied if they were given on the original invoice. Ensure that the Extend GST value matches on the newly created negative invoice and original invoice.

Insert a Notes line prior to adding credit lines to include an explanation for the reason for the credit.

Post the invoice for reference against the supplier account.