Preparation of the Return

To prepare and Close Off a GST Return select the Edit pencil beside the GST return.

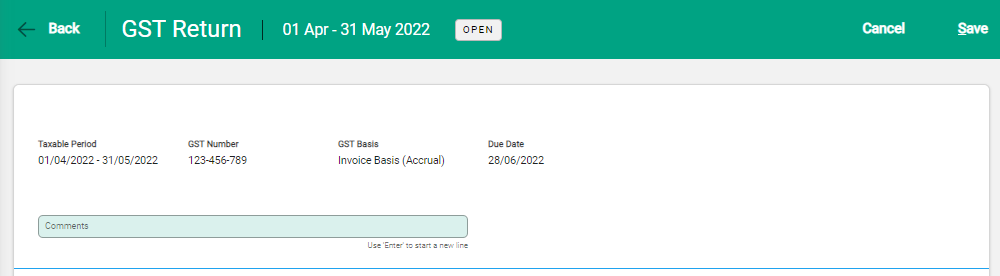

This opens the Return with the header displaying the pre-populated Taxable Period, GST Number and Basis, and the Due Date information. Use the Comments field to make and store additional comments if required.

Select Save to confirm the details.

With the Summary tab active, click on the Edit pencil.

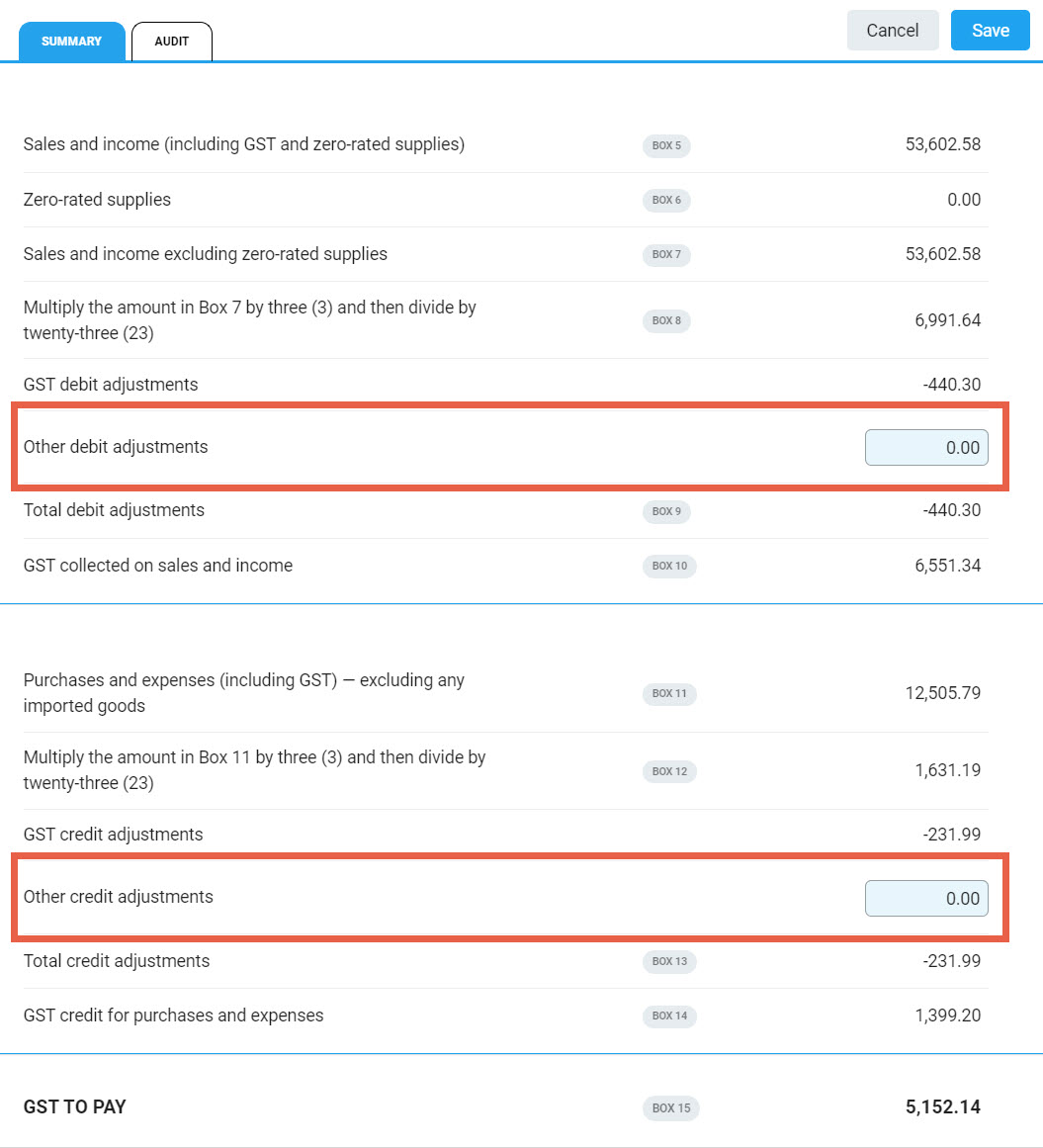

Summary tab

The Summary tab shows the return information and follows the same format as the IRD return. Fields are populated with figures drawn directly from transactions based on the GST Basis ie. Payments (Cash) or Invoices (Accrual).

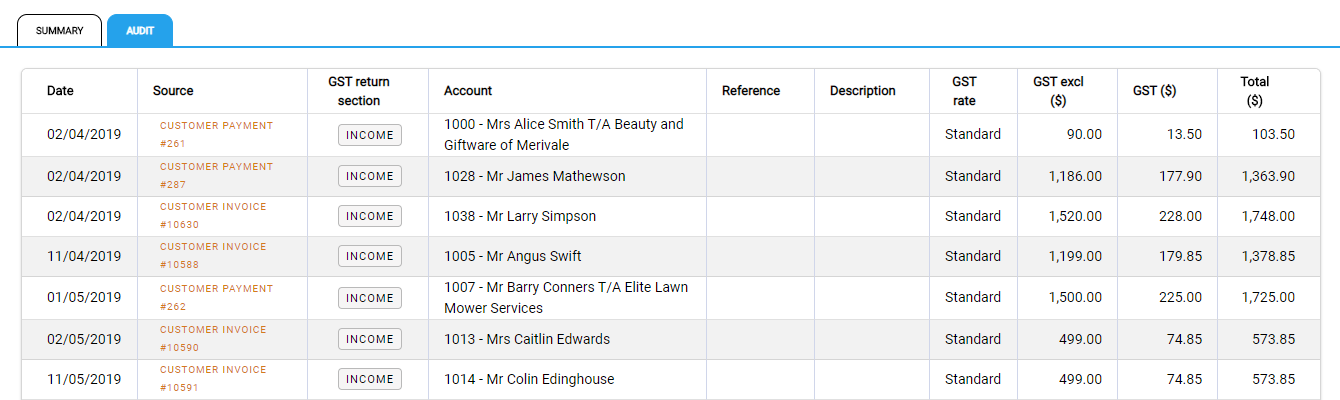

Audit tab

The Audit tab shows a detailed lists of all transactions included in the GST Return with the ability to drill into original transactions. Specific transactions can be found using the main search bar.

Complete the return on the Summary tab. Other debit adjustments and Other credit adjustments are editable fields. Make any required updates to each. Select Save to update the Total debit and credit adjustments and the GST to Pay. The return is saved and ready to Close Off.

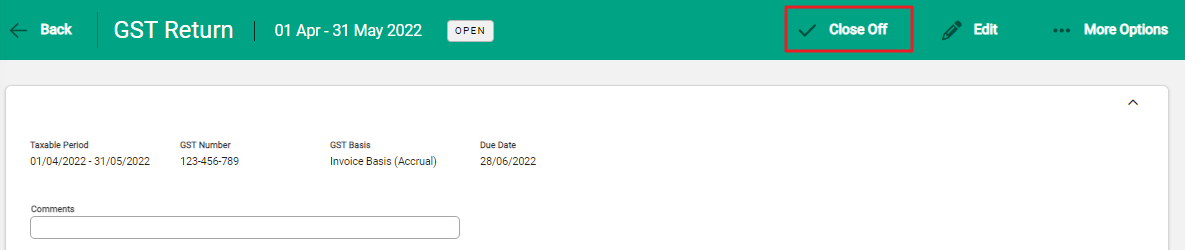

Close Off a GST Return

When a GST Return is prepared select Close Off from the toolbar to complete it.

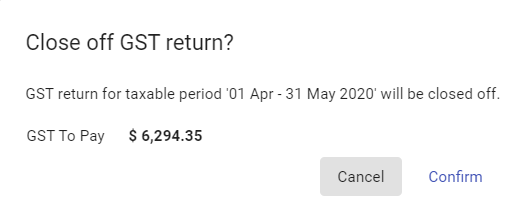

The confirmation window displays the Return period and amount of GST to be paid. Confirm to proceed.

A final confirmation message advises that the GST return has been closed off.

The return is now available to access as a GST Return Summary report.

To print or view the GST Report