When an asset, such as a new vehicle, is purchased entirely through finance it can be confusing on how to record it correctly within Infusion.

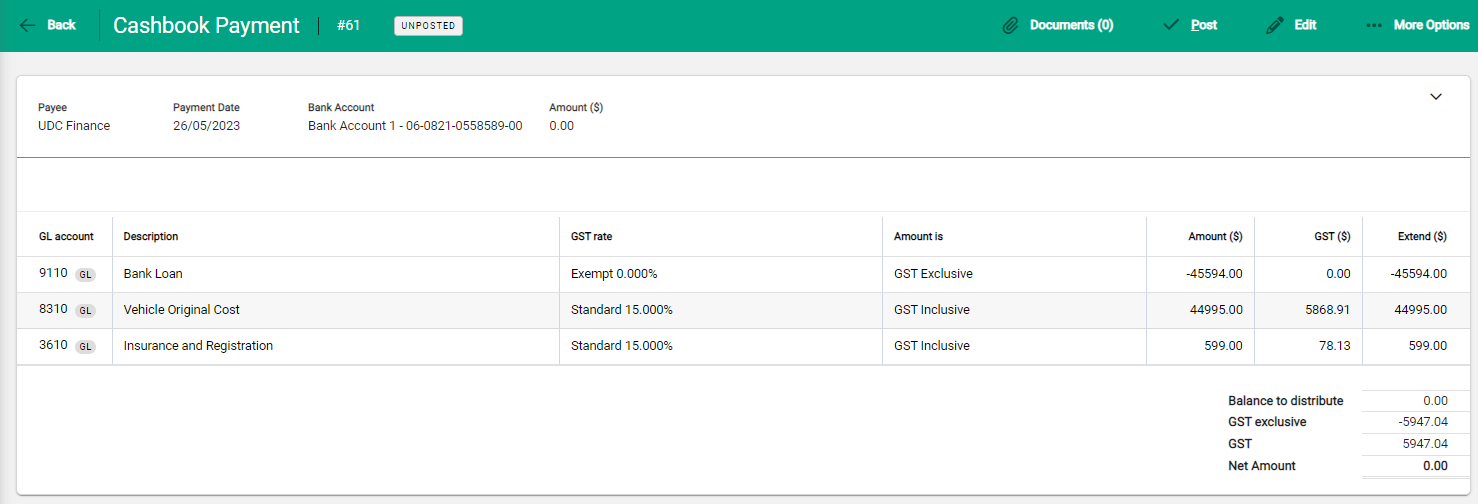

For example, your business has purchased a new Ford Ranger Ute on finance for $44,995 with On-Road Costs (ORC) of $599. The entire transaction is recorded in one Cashbook Payment screen and will look like this:

-

As we have purchased the entire vehicle on finance, there’s no initial cash outlay – meaning the payment amount is $0.

-

The GST figure represents the GST on the entire purchase, including all additional costs, such as the ORC amount.

-

Because the entire amount is financed, this is added as a negative entry to the Loan Account (9110).

- Note that the negative entry to the Loan Account is GST Exclusive.

If a deposit had been paid as part of the transaction, reduce the loan amount. This updates the Payment Amount to reflect the funds going out.

The loan amount is the net value, and excludes all interest and charges. These can be added by debiting the Interest in Advance account on the Balance Sheet and crediting the relevant Loan account