The underlying process for recurring payments is the same as for individual cashbook payments with slight differences being when creating and posting the recurring payment.

There are two ways to create a Recurring Cashbook Payment:

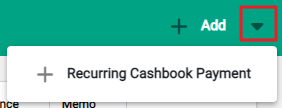

1) From the Cashbook Payments screen - click on the solid arrow beside +Add. Choose +Recurring Cashbook Payment.

2) From the Omni Icon, choose +Recurring Cashbook Payment from the Financials list.

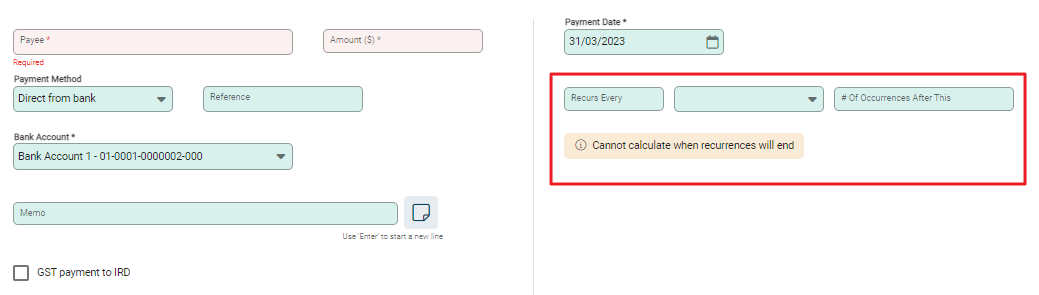

From either option the standard new cashbook payment screen displays along with additional fields to enter details about the recurrence.

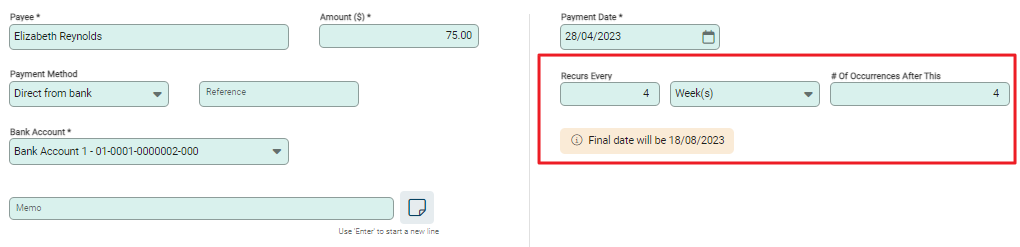

Enter the Payee, Amount and Bank Account details as usual. Also required is information to set the frequency and duration. Update as follows:

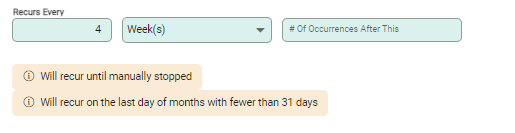

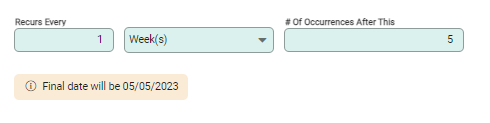

- Recurs Every sets the frequency of recurrence, i.e. once a week (one), every four weeks (four).

- Select the type of recurrence from the drop down – Day(s), Week(s), Month(s) or Year(s).

- # of Occurrences After This is used to set the number of additional recurrences to the original payment. Leave blank for an open-ended payment or enter a number for a fixed period.

Add line details to the cashbook payment as usual and Save to hold the payment or Post to complete.

Post Recurring Cashbook Payment

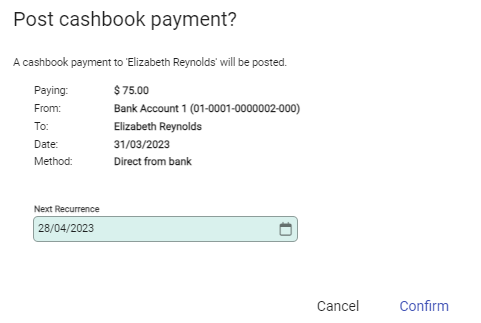

Posting a recurring Cashbook Payment has an additional step in the confirmation window.

The standard confirmation displays with the amount and date of the payment along with the Next Recurrence date. The Next Recurrence field is editable and any changes made will apply to all future remaining payments. These are automatically adjusted in accordance with the original frequency settings.

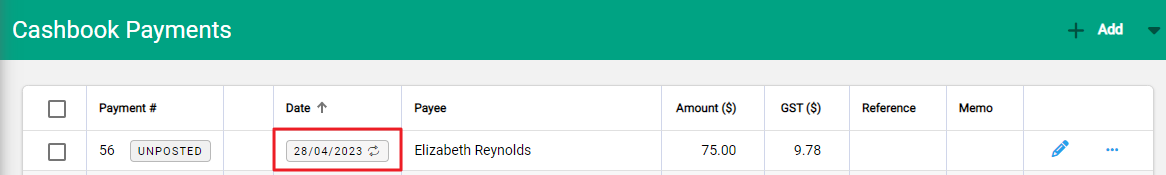

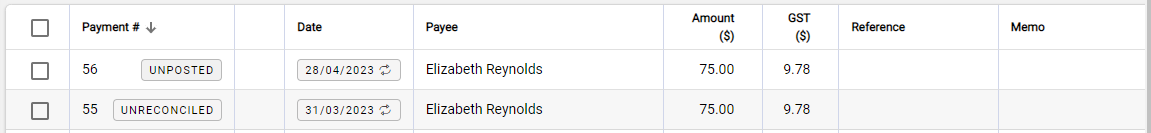

Confirm to post the payment and return to the Cashbook Payments screen. The payment displays with the next recurrence in the date column.

All Recurring Cashbook Payments display with a status or Unreconciled or Reconciled for the Posted transaction(s) and Unposted for the ongoing transaction.

Edit recurring date or frequency

To change the date that a payment recurs, or how often it recurs, click on the Edit pencil at the end of the row to open the recurring payment.

Update the recurring information fields and save. When # of Occurrences After This is populated, the Final date shows an end date. Save to record the change.

GL lines can be updated at this time if required, or go Back to return to Cashbooks Payments.

Stop recurring Cashbook Payments

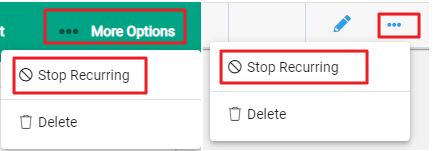

There are two ways to stop recurring cashbook payments. A payment must be Unposted for the recurrence to be stopped. Use either the Spill Menu at the end of the row or ...More Options within a payment to open the drop-down and choose Stop recurring.

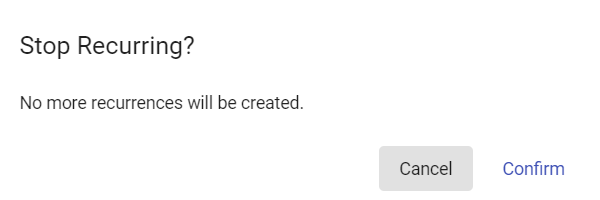

The pop-up window confirms to stop the recurrences. Confirm to proceed.

Convert existing Cashbook Payments to recurring

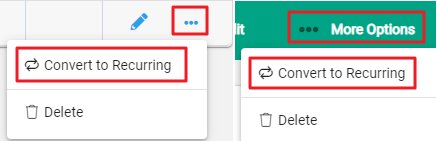

A cashbook payment must be Unposted in order to convert it to Recurring. To convert a payment use either the Spill Menu at the end of the row or ...More Options within a payment and choose Convert to Recurring.

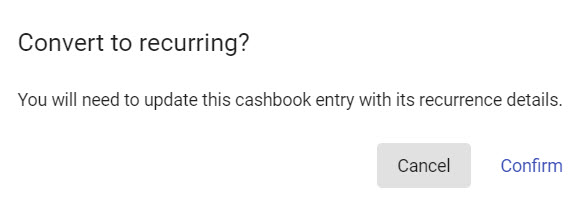

A confirmation window displays and advises that the cashbook entry needs to be updated. Confirm to open the cashbook payment.

The payment converts to Recurring and the recurrence details need to be set. Select Edit to open the payment for editing and update the recurring details. Save to complete.