To credit an item or an invoice, create a negative invoice (credit note) in POS in the same manner as a standard invoice.

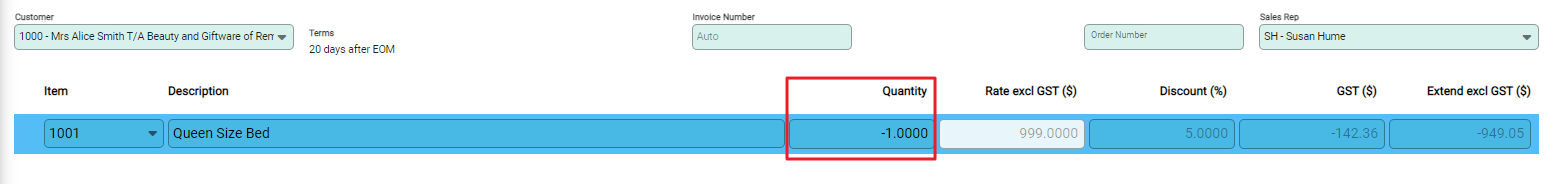

Enter the product(s) to be credited. In the Quantity field, enter the quantity to credit, using a negative value.

The Rate remains positive, and the Extend excl GST calculates to a negative total.

Continue to process the invoice as usual. When complete, select Process Sale. Select the payment method that the invoice will be credited to.

An invoice and payment both dated with today's date are created.

Integrated EFTPOS

If integrated EFTPOS is being used, notifications display on the pinpad screen as the refund is processed. As the steps are followed on the pinpad, the messages on screen update.

After processing the refund, select OK to confirm the transaction.

Selecting Cancel on screen during the refund process cancels the transaction.