New and Opening Journals both follow the same process for creation and posting although they are used for different purposes.

- Choose New for a standard and standalone journal entry

- Choose Opening when:

- creating Opening or Conversion Date balances

- entering journals that require access to control (Customer / Supplier / GST etc) GL accounts.

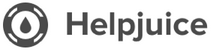

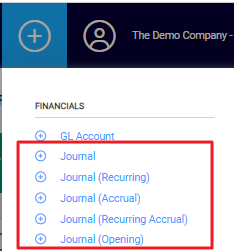

To create a journal, go to Financials > Journals. From the toolbar, choose +Add for a New Journal, or use the drop-down arrow to choose Opening Journal. Alternatively, use the Omni icon.

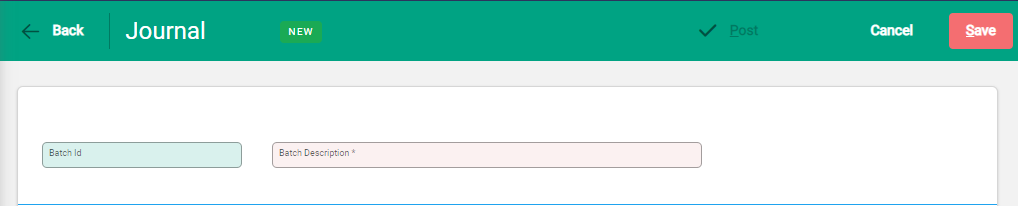

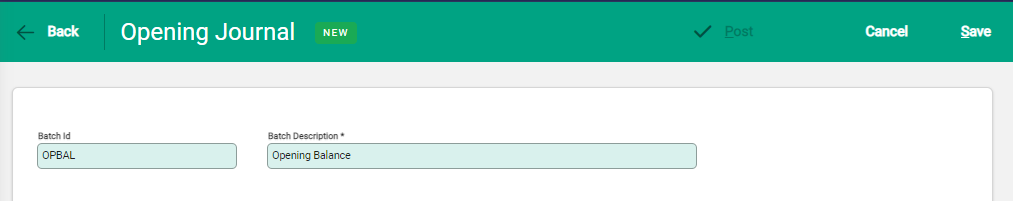

The new journal window opens with the journal type displaying in the toolbar. Give the journal a Batch ID and Batch Description.

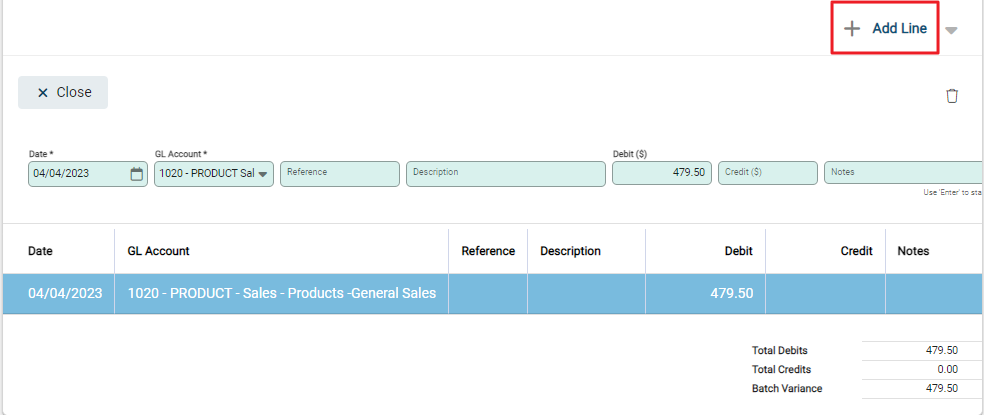

Select +Add Line to start adding GL Accounts for the journal entry.

Add line items to the batch, updating the GL Accounts and amounts. Notes are optional to add further clarity or explanation. The active line is highlighted and is updated in real time as the entry fields are populated.

To continue adding lines, select +Add Line as each new line is required. When there is information in the Reference and Description fields, this carries through from the previous line to the new one and can be edited or cleared as required.

To edit or delete a line, select it from the table to make it active. Either make changes in the entry fields or select the delete icon above the entry fields.

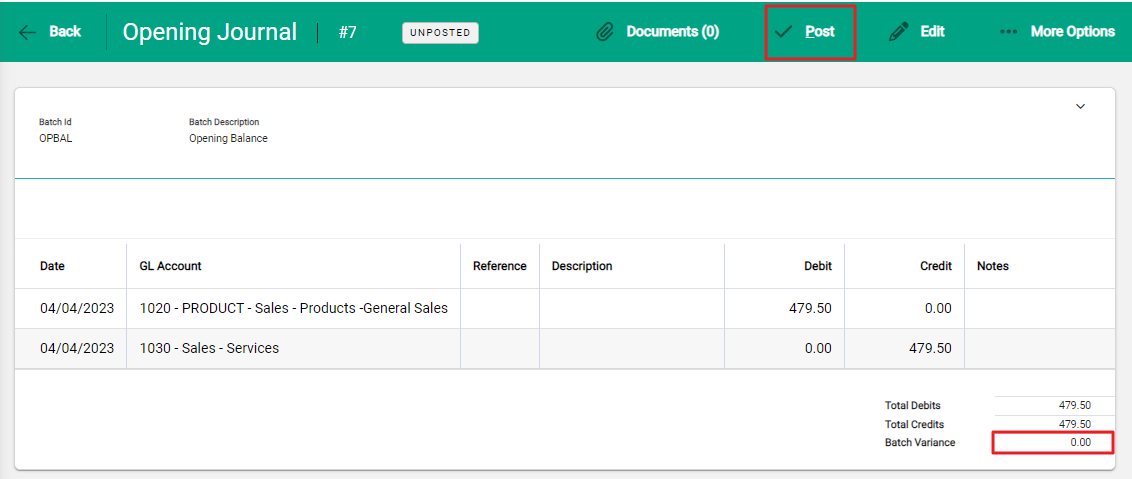

The Batch Variance at the bottom right of the screen displays the Total Debits and Total Credits along with any variance. There must be no variance before the batch can be posted.

When all lines have been added select Post.

A confirmation window will display. Select Confirm to complete. The journal is posted and becomes a recorded financial transaction. GL Account balances are updated.

Posting a journal in a closed financial year

To post opening journals in a closed financial year, open the Settings module and choose Financial Settings.

Select Edit

Enable Allow opening journals in closed financial years using the slider bar.

With this setting active, opening journals can be dated in a closed financial year.

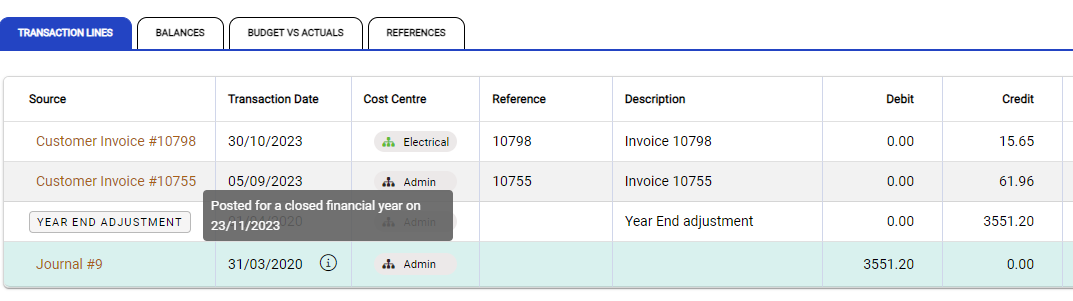

When the adjustment is viewed in an Enquiry screen, if you hover the mouse over the transaction line a message displays advising that the transaction is posted for a closed financial year: