The Retained Earnings account is updated each year upon the completion of the Financial Year Close Off. It is a cumulative account used for reporting purposes only and is not available for transactions or journals.

Set a Retained Earnings GL Account

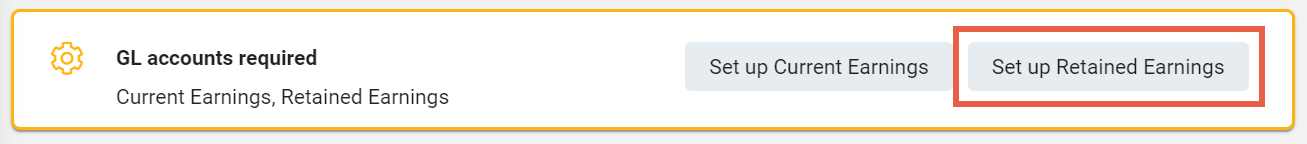

When setting up Infusion for the first time a Retained Earnings GL Account must be created.

A notification displays on the Home page to create the GL Account. Select to complete.

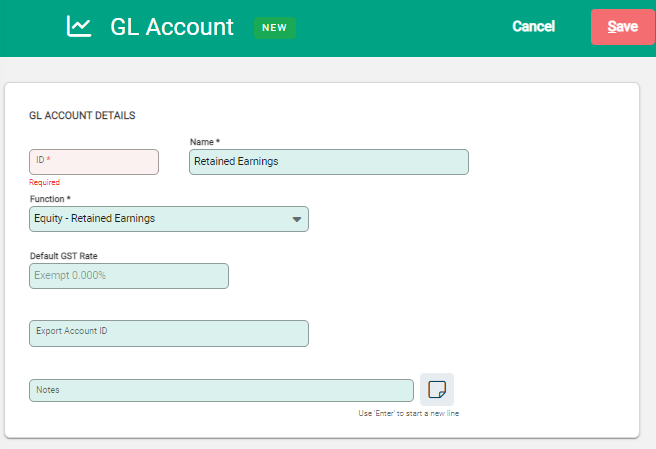

The new GL Account window opens.

- The Account Name is pre-populated and can be edited if required.

- Function is set to Equity - Retained Earnings. Only one GL Account can be set to this function.

- The Default GST Rate is set to zero as the account is not applicable for GST.

Update the Account ID and Save.

Retained Earnings Account Enquiry

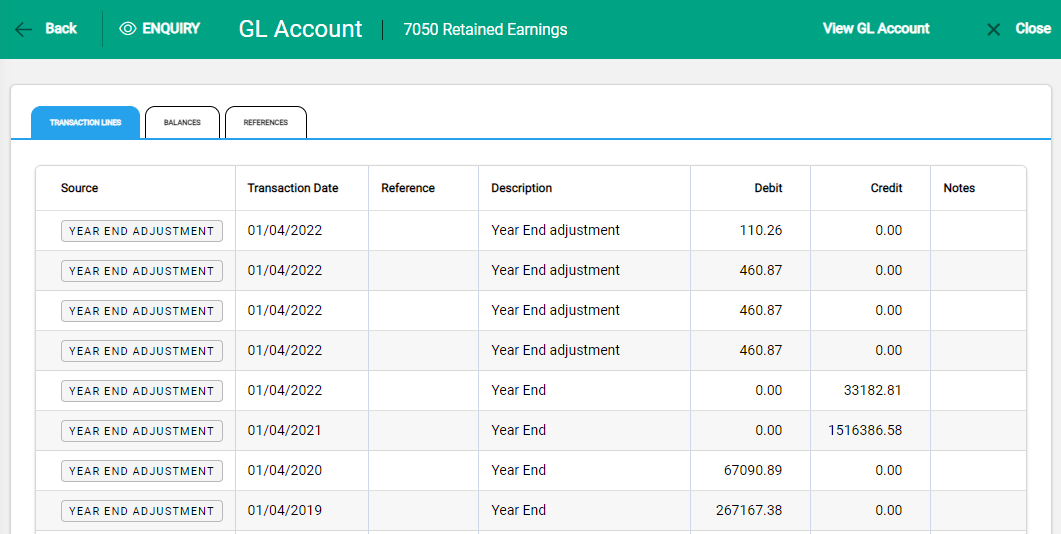

Enquiry shows activity against the Retained Earnings Account with information displayed on different tabs. To open, choose Enquiry from the toolbar within the account.

Transactions tab

When the Financial Year is closed off, the balance of the Income or Expense account is updated to the Retained Earnings Account and these display as Year End Adjustments.

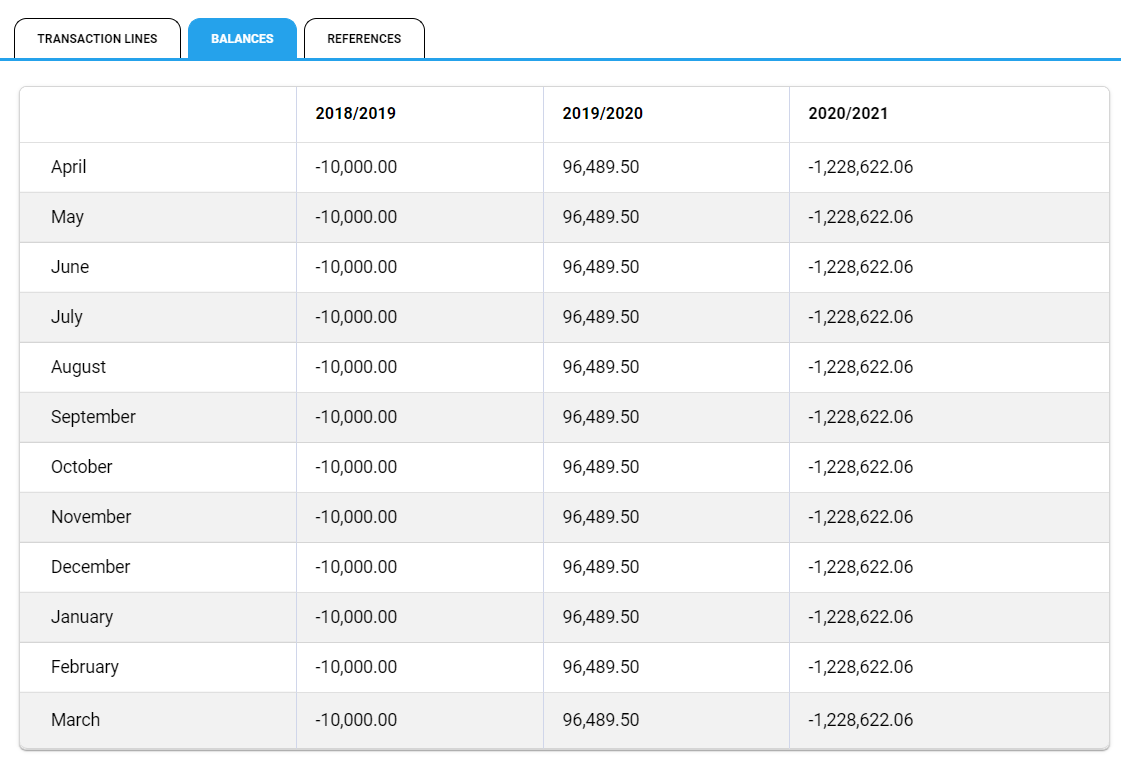

Balances tab

The amount displayed on the Balances tab reports through to the Balance Sheet and is the total of all Year End Adjustments for the financial year.

When the Financial Year is closed off, the Retained Earnings balance is adjusted to reflect the latest close off. Balances remain static throughout the financial year (unless there is a further transaction created for the previous year).

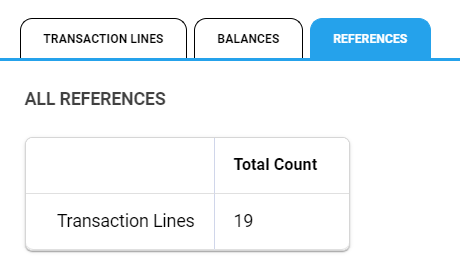

References Tab

The References tab shows the amount of times the Retained Earnings GL Account has been referenced and is a count of all Year End Adjustments.