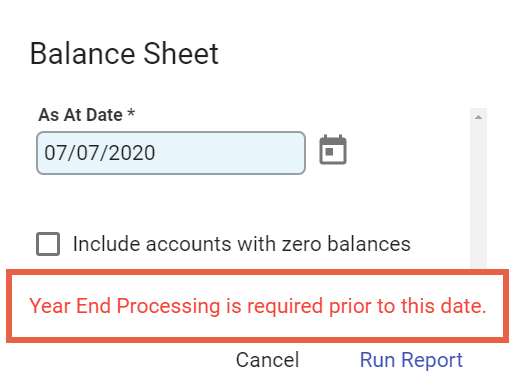

The Financial Year is Closed Off when the majority of the transactions for the preceding financial year have been entered

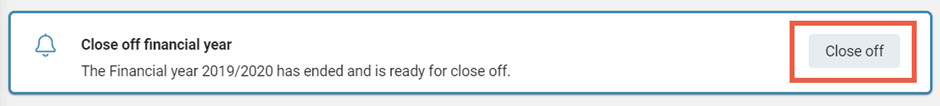

On the first day of the new financial year a notification displays on the Home Page in readiness for Close Off. The Close Off is recommended to be completed after most of the standard monthly transactions are entered. This allows opportunity for final invoices to be received and transactions to be completed.

Closing off resets all Income and Expense (Profit & Loss) GL codes back to zero in a year close journal.

Entering transactions (such as accountant's year end journals) can be completed without restriction into the preceding Financial Year - each transaction will close itself off.

Complete the Close Off

When you have completed your bank reconciliation for the year end, and entered as many creditor invoices as possible for the previous month, go to the Home Page. On the notification message, choose Close Off.

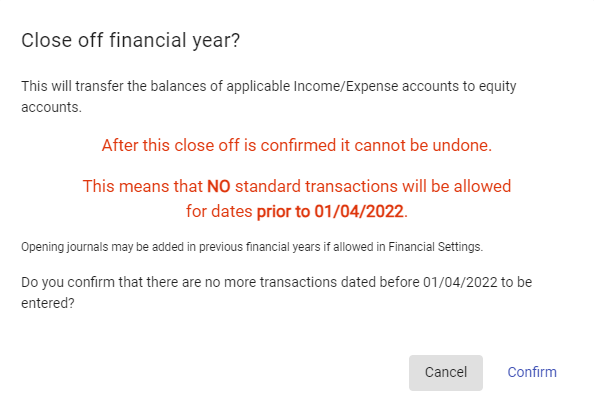

A window will appear asking you to confirm that there are no transactions earlier than the specified year start date that need to be entered. Select Confirm.

The Close Off is processed and a confirmation notification displays. On completion:

- Income and Expense accounts are reset to zero as at the start of the financial year.

- Balances for the closed off year are transferred to the Retained Earnings GL Account.

- Year End Adjustments are applied to accounts. The Retained Earning GL Account Enquiry - Transactions tab provides more detail on these adjustments.